Through on-the-job experimentation, guidance from seasoned professionals, and continued education, Chris has developed a recipe for success and the numbers prove it.

“For every marketing campaign that I develop and implement, I immediately follow it with a series of measurement metrics. By analyzing the data and reviewing the trending values (up, down, or even), I gain a better understanding of what it takes to influence desired growth. Following the data is what enables me to correctly re-tool the campaign for greater success down the road.” – Chris Spicer, Marketing Professional

Recent accomplishments include:

Chris was responsible for the development of the Consumer Marketing program for the company’s financial institution client base (over 500 clients); which includes the development of a subscription-based Electronic Library program, featuring over 50 downloadable customizable marketing campaigns, which are designed to drive consumer adoption of online banking, personal financial management and online bill payment products.

Data reveals that when clients use these campaigns, they realize online bill payment adoption rates in the region of 20-40%, in comparison to the average rate of 12% achieved by clients that do not perform marketing. The Consumer Marketing project cost less than $100,000 to develop and it is projected to earn over $3 Million in new net income (combined income from transactions and subscriptions) by the end of the first year; with modest projections to generate over $5 Million in net income in the second year.

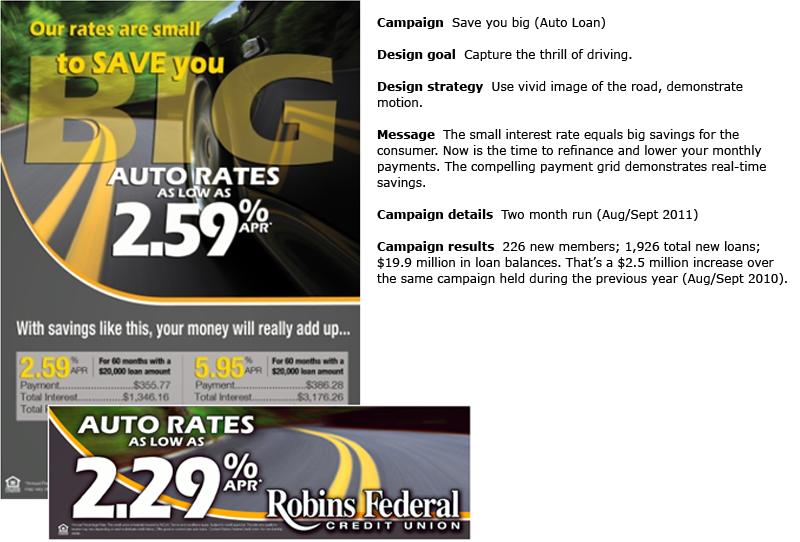

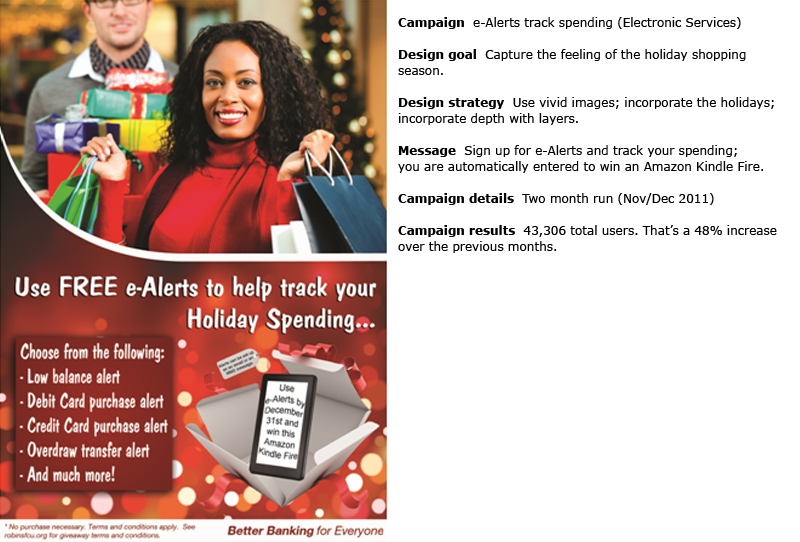

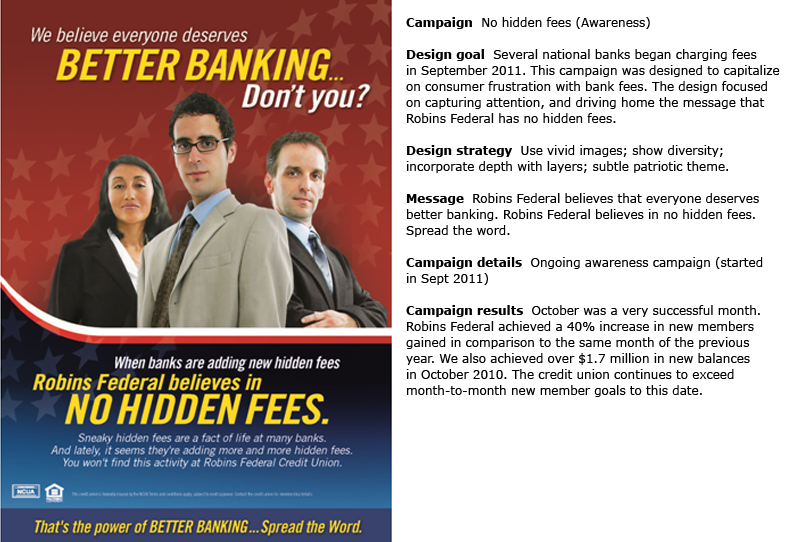

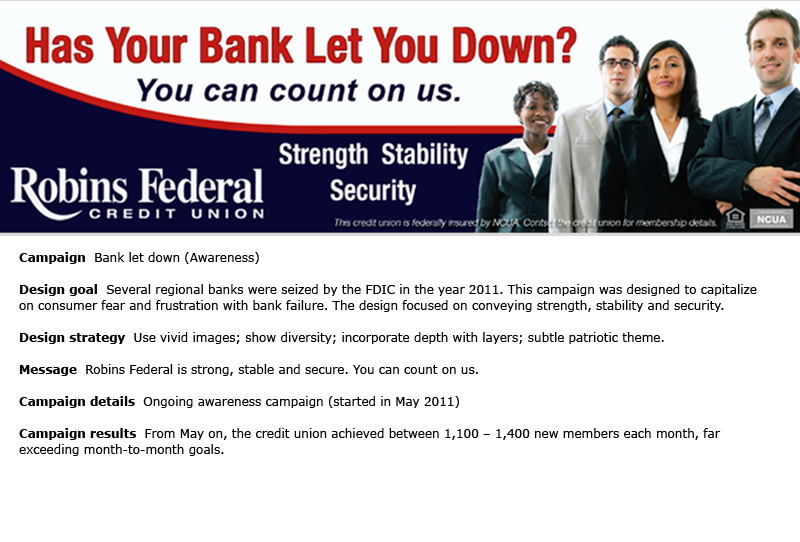

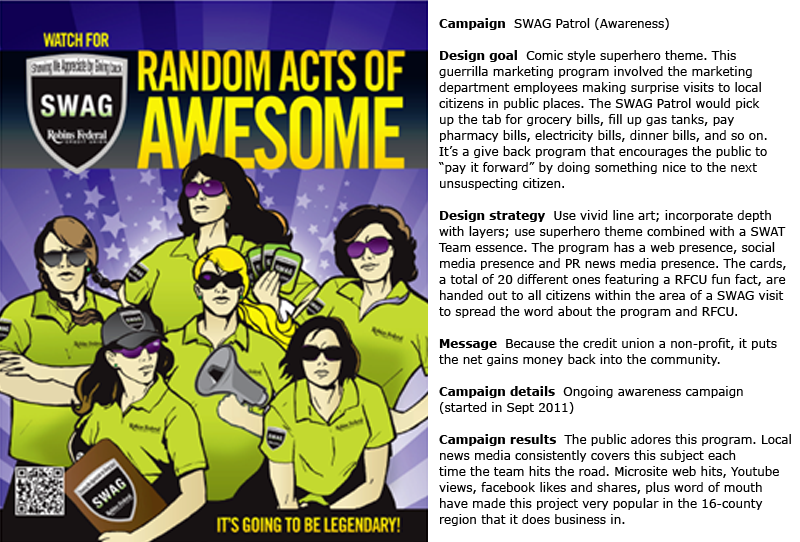

As the leader of the Marketing team, Chris was responsible for the development of a winning marketing strategy to meet aggressive growth goals, which included an increase in loans, memberships, 16-county market share, overall public awareness and increased community involvement exposure through a combination of marketing and public relations tactics.

Through the development of innovative, attention-grabbing and award-winning* campaigns, several new and modified marketing tactics, plus several creative public relations initiatives were deployed, helping the organization achieve the following milestones at the close of 2011:

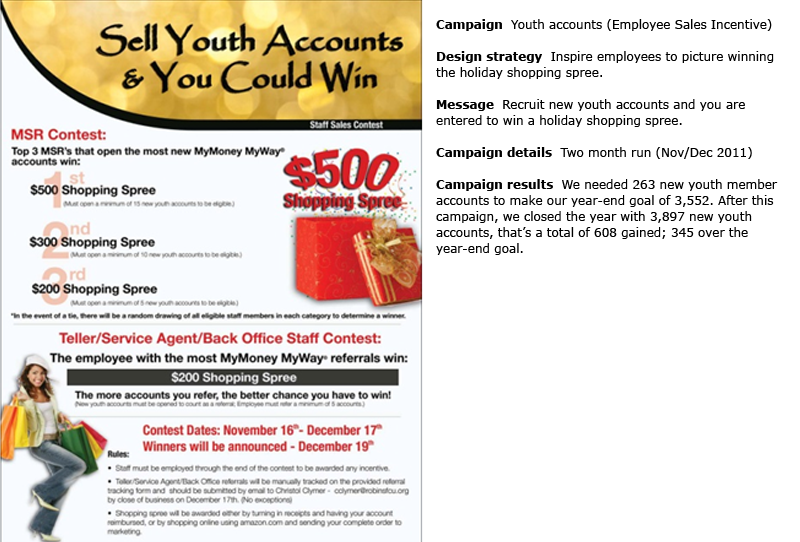

During a period when banks across the nation endured tremendous public angst and protesting, and regional banks suffered closure by the FDIC, Robins Federal experienced rapid growth, by promoting the “You can count on us” message that welcomed new members by the thousands. As national banks attempted to install debit card usage fees, Robins Federal promoted the “We believe in no hidden fees” message that helped gain thousands more new members. In 2011, the credit union achieved over 12.5% new member growth. Strategic focus on growing membership with the youth market was achieved with an impressive 15% increase over the year prior.

In summary, the organization achieved phenomenal growth during the year 2011, far exceeding peers in all key financial performance areas, as reported by the independent and industry-respected market research and profitability analysis firm Raddon Financial Group. Total assets grew 15.8% to $1.59 billion; Total deposits grew 15% to $1.37 billion; Total loans grew 5.9% to $844 million; Total membership grew 5.7% to 140,372, plus an estimated value of over $90,000 in press coverage.

* Achieved 3 top Industry-respected awards in 2012: two CUNA Diamond Awards in Categories Best for Community/PR Program and Direct Mail Series, plus Silver ADDY Award for TV Commercial Series from the Advertising Federal of Central Georgia