-

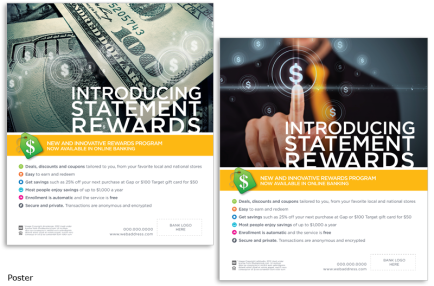

Statement Rewards

The Statement Rewards program recently launched to all financial institution clients. The program is featured in the online banking environment, where consumers can select money-saving rewards, deals, discounts and coupons. The purpose of this campaign is to introduce the new program and inspire consumers to use it often. Offers are based on banking account spending history, so the goal of the program is to encourage debit card use. As the program gains consumer adoption, all parties make a cut of the consumer spending: the merchant who presents the offer, the Statement Rewards team, the financial institution, and ORCC/ACI.

Category: Advertising, Consumer Awareness, Incentive ProgramMedia: Traditional, DigitalClient: ORCC/ACI -

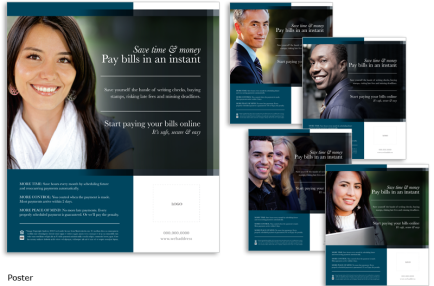

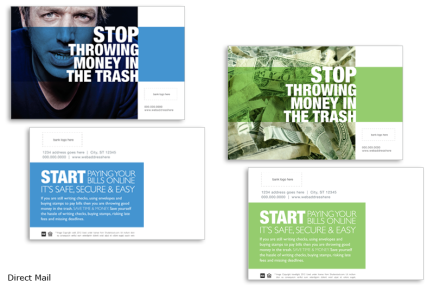

Online Bill Pay 1

This campaign focuses on promoting Online Bill Payment. Data reveals that when banks use these campaigns, they realize online bill payment consumer adoption rates in the region of 20-40%, in comparison to the average rate of 12% achieved by clients that do not perform this marketing. Banking customer retention rates remain higher with consumers who regularly engage in online banking and bill payment programs, so we advise clients to promote online bill payment year-round, switching it up a few times a year to keep the message fresh and top-of-mind.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

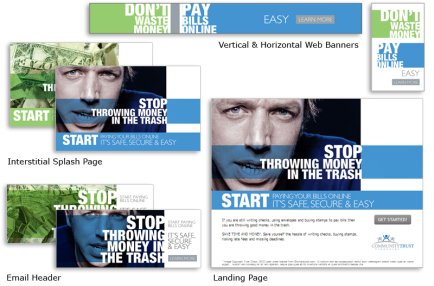

Online Bill Pay 2

Bank customer retention rates remain higher with consumers who regularly engage in online banking and bill payment programs, so the goal is to promote online bill payment year-round. The challenge is to keep the message fresh and top-of-mind with the consumer. To get attention and “break through the clutter”, sometimes the use of unusual images and thought-provoking copy is what it takes.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

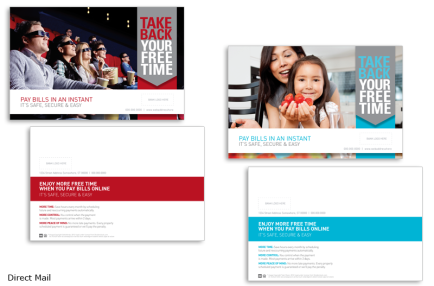

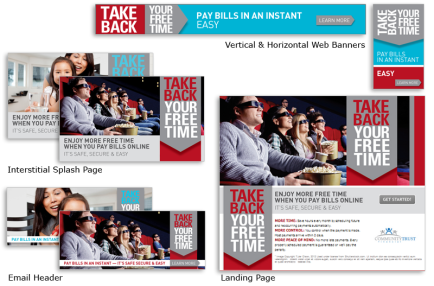

Online Bill Pay 3

As banks promote Online Bill Payment year-round, the challenge is to update the campaign to keep the message fresh and top-of-mind. One popular and effective method is to rotate the images and copy to reflect the changing seasons. These campaign images work year-round because they focus on popular indoor activities. The goal of this campaign is to encourage the audience to think about what they would do with more free time; which is the benefit of switching to online banking.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

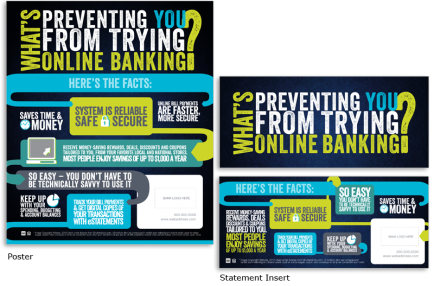

Online Banking, What’s Preventing You?

This campaign gets straight to the point and asks “What’s preventing you…” which is not the typical approach to bank advertising; which is also why this ad will “break through the clutter” and get consumer attention. Equally untypical, is the use of infographics to display the long list of benefits associated with online banking. This campaign makes the activity of consuming a lot of information more interesting and entertaining.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

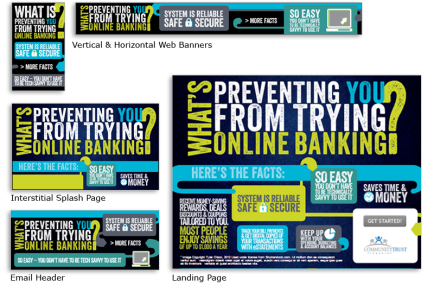

Online Banking Security

Security is a top concern for most consumers, and the barrier to entry for most. Banks must initiate the conversation and address this concern if they wish to recruit the online banking adoption-Laggards. This campaign gets straight to the point by promoting online banking as the secure solution to preventing fraud and identity theft.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

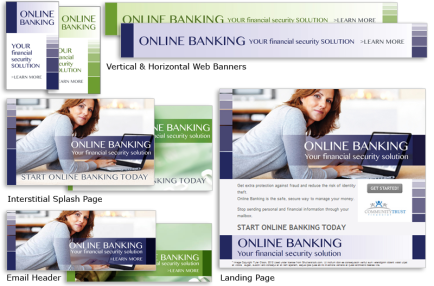

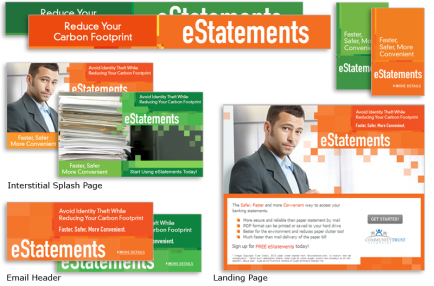

eStatements

It’s a fact, eStatements are more secure than paper statements; and by switching to eStatements, the consumer decreases their chances of becoming a victim of fraud. eStatements also save money, by reducing printing and postal expenses for the bank.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

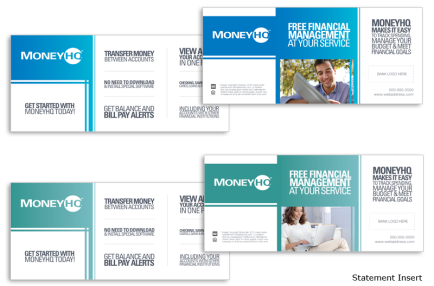

MoneyHQ

MoneyHQ is a personal financial management tool, featured within the online banking environment. This product provides another layer of online banking consumer engagement, thus increasing customer retention rates with product adoption. The goal of this campaign is to highlight the ease of use and benefits of the product; thus, encouraging consumers to give it a try.

Category: Advertising, Target MarketingMedia: Traditional, DigitalClient: ORCC/ACI -

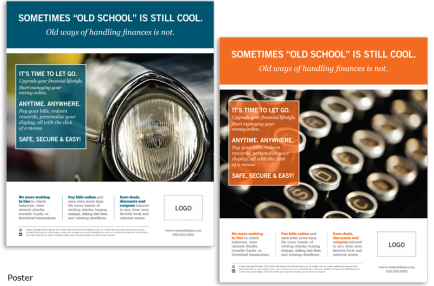

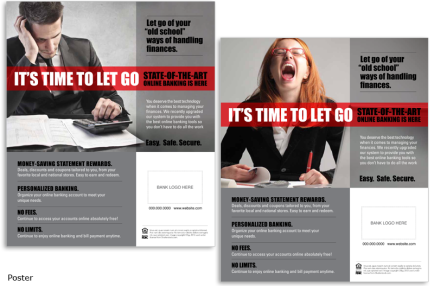

Online Banking

This campaign targets one of the largest groups of online banking adoption-Laggards: consumers aged 60+. Using images that pay respect to the past, while using copy that makes a play on the term “old school”, this campaign encourages consumers to upgrade their financial lifestyle with online banking.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

Bill Pay Sweepstakes

This campaign promotes a sweepstakes program that encourages consumers to use the online bill payment product. Each online bill payment transaction is treated and an entry into the sweepstakes. At the end of the 2-month period, one randomly-selected $5,000 winner is announced. This campaign was held during November and December of 2012, thus it focuses on spending time with friends and family during the winter/holiday season.

Category: Advertising, Incentive ProgramMedia: Traditional, DigitalClient: ORCC/ACI -

Online Banking Upgrade 1

This campaign is designed to help the financial institution client announce the recent upgrade of their online banking offering and to encourage consumers to use these programs and services that are now available. This campaign highlights several key benefits of the online banking product.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

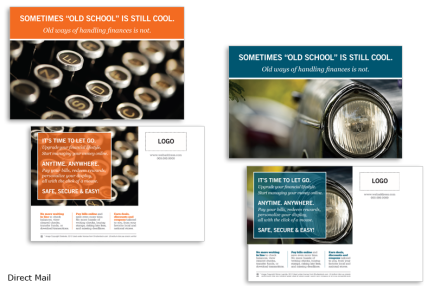

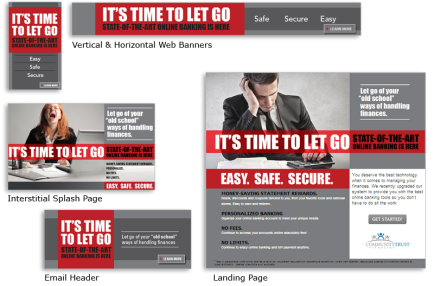

Online Banking Upgrade 2

This is an alternative campaign designed to help the financial institution client announce the recent upgrade of their online banking offering, while encouraging the adoption-Laggards to use these programs and services that are now available. Using images that capture the frustration of “old school” ways of handling financial management, this campaign encourages consumers to “let go” by upgrading their financial lifestyle with online banking.

Category: Advertising, Consumer AwarenessMedia: Traditional, DigitalClient: ORCC/ACI -

KBA Notification

KBA, Knowledge Based Authentication, recently became the federally-mandated standard for verifying the authenticity of the consumer during online banking transactions, as an additional measure to reduce fraud. Communicating details about this program became a priority to financial institutions, as consumers would naturally become concerned about the volume of personally-identifiable questions that they were being asked during their online banking sessions. This campaign was designed to communicate the security and benefits of the KBA program.

Category: EducationMedia: DigitalClient: ORCC/ACI -

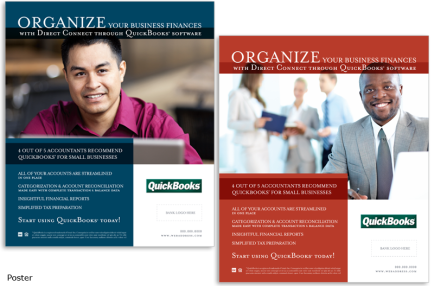

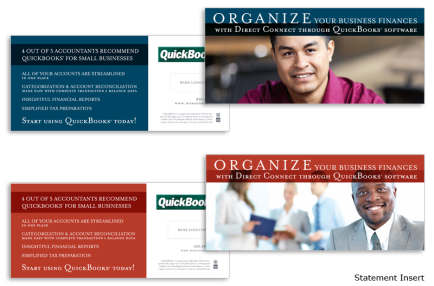

QuickBooks 1

QuickBooks is a nationally-recognized small business financial management tool that runs within the online banking environment. This campaign is designed to communicate the benefits of the program to small business banking account customers, by outlining the features relevant to their needs.

Category: Advertising, Target MarketingMedia: Traditional, DigitalClient: ORCC/ACI -

QuickBooks 2

This campaign is designed to get attention and draw the audience in to the message. It communicates the features and benefits of the QuickBooks program, which is the nationally-recognized small business financial management tool that runs within the online banking environment.

Category: Advertising, Target MarketingMedia: Traditional, DigitalClient: ORCC/ACI -

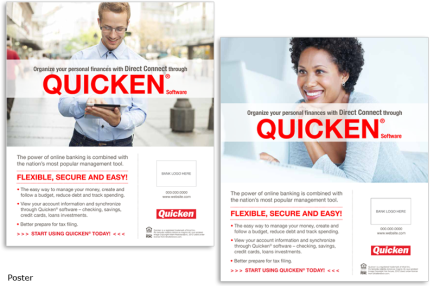

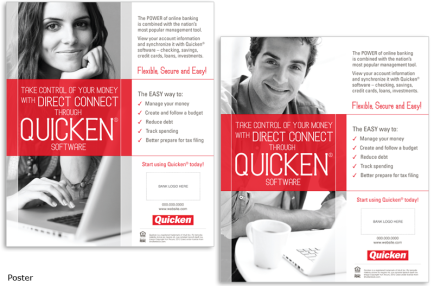

Quicken 1

Quicken is a nationally-recognized personal financial management tool that runs within the online banking environment. This campaign is designed to communicate the benefits of the program to banking consumers, by outlining the features relevant to their needs.

Category: Advertising, Target MarketingMedia: Traditional, DigitalClient: ORCC/ACI -

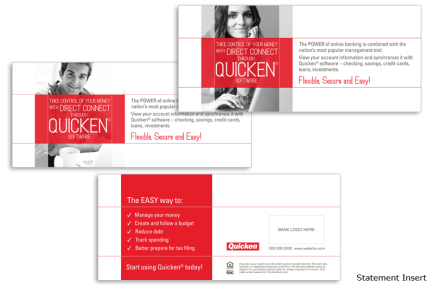

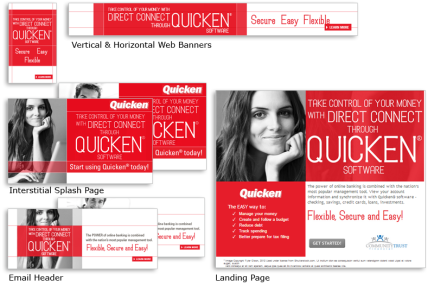

Quicken 2

This is an alternative campaign to promote Quicken, a nationally-recognized personal financial management tool that runs within the online banking environment. This campaign communicates the benefits of the program to banking consumers, by outlining the features relevant to their needs.

Category: Advertising, Target MarketingMedia: Traditional, DigitalClient: ORCC/ACI -

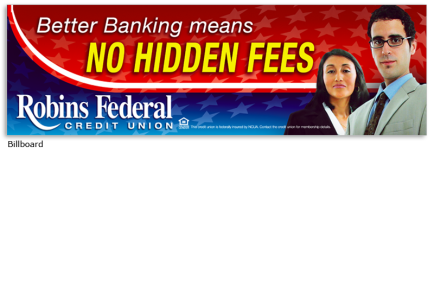

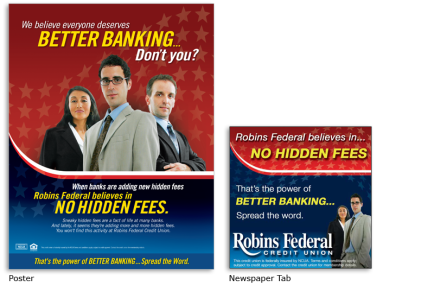

No Hidden Fees

Around the mid-point of 2011, national banks attempted to install debit card usage fees to help recover from income loss with credit card transactions due to the Durbin Amendment. As a result, the public backlash was intense, so this campaign was launched to counter the banks and promote Robins Federal Credit Union as the solution. This timely campaign communicated the credit union’s commitment to no hidden fees, which helped generate thousands of new customers.

Category: Branding, Consumer AwarenessMedia: Traditional, DigitalClient: RFCU -

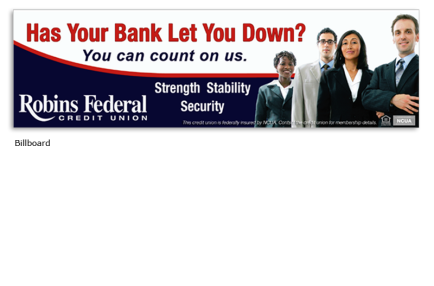

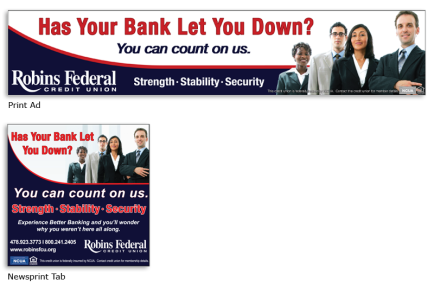

Bank Let Down

During a period when banks across the nation endured tremendous public angst and protesting, and regional banks suffered closure by the FDIC, Robins Federal experienced rapid growth in 2011, by promoting the “You can count on us” message that welcomed new members by the thousands.

Category: Branding, Consumer AwarenessMedia: Traditional, DigitalClient: RFCU -

Auto Loan 1

This campaign was designed to capture the joy and care-free nature of vacation, plus the enthusiasm of owning a new car. The benefit of this campaign is in the delay of the due date for the first payment; which encourages the audience to consider the value of 3 months worth of loan payments while thinking about what they would do with the extra money. This campaign also targeted currently-financed vehicle owners to consider re-financing their auto loan to take advantage of the 3-month reprieve from loan payments.

Category: AdvertisingMedia: Traditional, DigitalClient: RFCU -

Auto Loan 2

2012 was a great year to get an auto loan. With APR rates below 3%, banks and credit unions were competing to promote their loans. This campaign sought to get attention by visually capturing the thrill of driving on the open road, and it succeeded at getting attention by being displayed on eye-level billboards that line most of Middle Georgia’s major commuter routes. The poster outlines the total-value savings of refinancing to a lower-rate auto loan.

Category: AdvertisingMedia: Traditional, DigitalClient: RFCU -

Auto Loan 3

In an effort to get as many auto loans as possible before the year-end close of 2011, this campaign sought to promote auto loans during a time when historically loan “sales” are low. This campaign focused on the usual stress and financial frustration of consumers during the holiday season, offering the solution: a stress-free holiday by refinancing your auto loan. With a 90-day reprieve from loan payments, the consumer gains extra spending cash and “financial freedom” during an otherwise typically stressful time of year.

Category: AdvertisingMedia: Traditional, DigitalClient: RFCU -

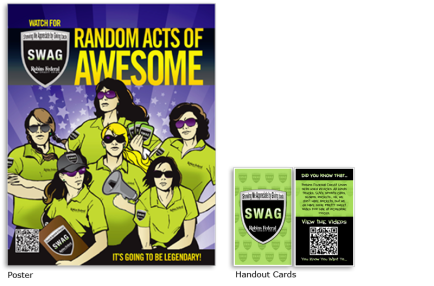

SWAG Patrol

This campaign sought to promote the generous nature of the credit union, and encourage consumers to “bank with the good guys”. Because the credit union is non-profit, one of the ways they re-distribute their profits is by giving to community causes, such as worthy non-profit initiatives. This program sought to give-back to individuals in the community by popping up in the community and paying for gas, groceries, utility bills, etc. The program gained major local news media coverage and social media following.

Category: Consumer Awareness, Public RelationsMedia: Digital, SocialClient: RFCU -

Mortgage Loan

This campaign sough to make a play on the term “getting more for your money” by promoting that mortgage rates are so low at RFCU, that you get “more home for your mortgage”, implying that the audience could get a higher value home with their savings. With vivid images of desirable elements of new homes, this campaign generated consumer demand for home loans.

Category: AdvertisingMedia: Traditional, DigitalClient: RFCU -

Home Equity Line of Credit

This campaign focuses on the unlimited opportunity that a Home Equity Line of Credit gains the consumer. Using a visual play on a retro game show theme, this campaign announces “Let’s Make it Happen!” encouraging the audience to role play the contestant position and think about what they would do with a bunch chunk of extra money. HELOC isn’t for everyone, at all times, so this specialized campaign is used in target marketing efforts to gain more hard leads, and some traditional media for more soft (consumer awareness) leads.

Category: Advertising, Target MarketingMedia: Traditional, DigitalClient: RFCU -

eAlerts

During the holiday season, this campaign sought to promote the effectiveness of using eAlerts to help consumers manage their money during a time of high-volume spending. With the added incentive of being entered to win a new Kindle Fire tablet, which would make for a great gift at this time of year, this campaign successfully encouraged consumers to adopt the eAlerts product.

Category: Advertising, Consumer Awareness, Incentive ProgramMedia: Traditional, DigitalClient: RFCU -

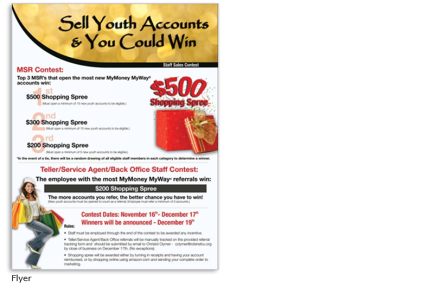

Youth Accounts

This campaign sought to inspire employees to promote the Youth Account product during the holidays, as a year-end push to reach annual growth goals for this category. This campaign was designed to entice employees to “sell” youth campaigns, with the top three sales leaders winning shopping sprees. Weekly updates were broadcasted as reminder of the program, in addition to stirring up competition among the employees. The results of this campaign exceeded expectations, helping the company exceed the year-end growth goal for this category.

Category: Incentive Program, Target MarketingMedia: Traditional, Digital, SocialClient: RFCU